Welcome to the Era of American Inflation

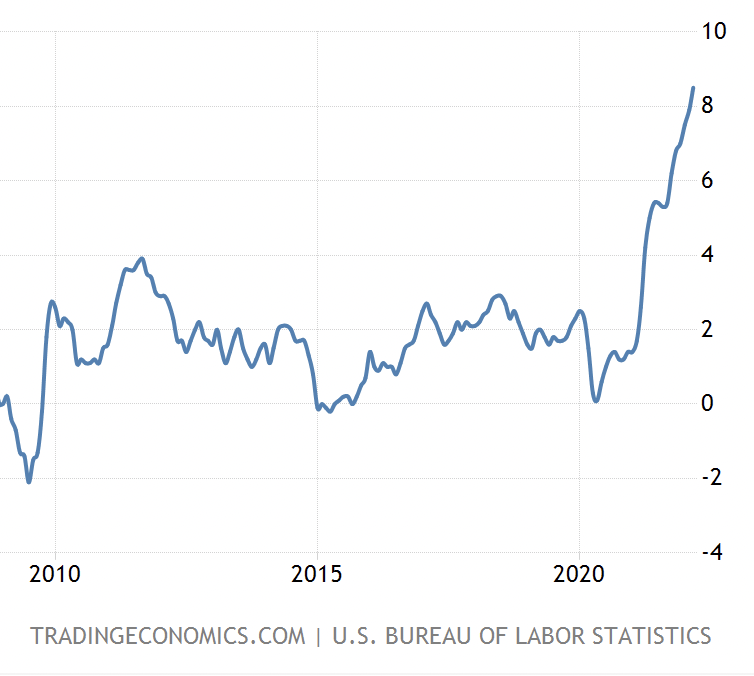

Today, we live in an economy that is constantly changing. However, the most salient change is the increased prices for almost everything we purchase in the past few months. The high inflation rates will only aggravate before they slow down, and as of now, most economists predict that the current trend could last for years. With sophisticated tools to turn the data into useful information to strategize for future decisions, inflation is predicted to persist. Thus, economic managers and the federal government need to consider raising interest rates, wages, and selling assets.

It is crucial to understand the root causes behind high inflation rates as businesses struggle to adapt to the reopening economy, and people’s daily lives are being immensely affected. Some of the main problems we can see today include rising energy prices, gas prices, supply chain disruptions, corporations’ struggle with finding qualified employees, and the shortage of goods for the rapidly increasing demands. High inflation rates are caused by high consumer demand in the economy met with a low supply of resources. The recent quarter of high inflation was mainly encouraged by the rise in prices for services, durable goods, and nondurable goods. Lower-income households spend most of their income on services and durable and nondurable goods. However, as they represent a smaller share of overall spending, they are underrepresented in the price indexes that track average consumer spending. Although lower-paying jobs offer wages exceeding the pre-pandemic norm to preserve their current workforce, the rapidly increasing prices of goods have not been controlled to meet the salary raises. The imbalance between wage spikes and price increases could also directly impact the country’s economy as consumers may delay purchasing demands if prices continue to rise. These factors have caused a rapid increase in overall inflation, followed by higher prices of goods that put a significant economic burden on many families across the country.

Most supply chain issues are expected to resolve by themselves when the supply begins to align with demands. To prevent the “wage-push” inflation from occurring in the future, it will require more labor productivity in promising production industries to ameliorate the situation. If the investments in industries such as information-processing equipment generate sufficient future productivity growth to rise and offset wage increases, then wage increases can be supported without increasing labor costs. To resolve the current dilemma, the federal government should raise interest rates, control wages, and start shrinking or selling their assets to put economic growth on hold. However, if the government perseveres with controlling inflation, there will be the possibility of a mild recession, while the growth of inflation rates will be put on hold. But if inflation is not dealt with now, the postponement will only keep the pain away for some time before the government will have to shrink its assets further to deal with the inflation. As a result, this may lead to an even more severe recession.

Therefore, business corporations and the federal government should consider shrinking interest rates, wages, and selling their assets to slow down the economic growth, along with investing in informational equipment for a thorough analysis of the current inflation trend